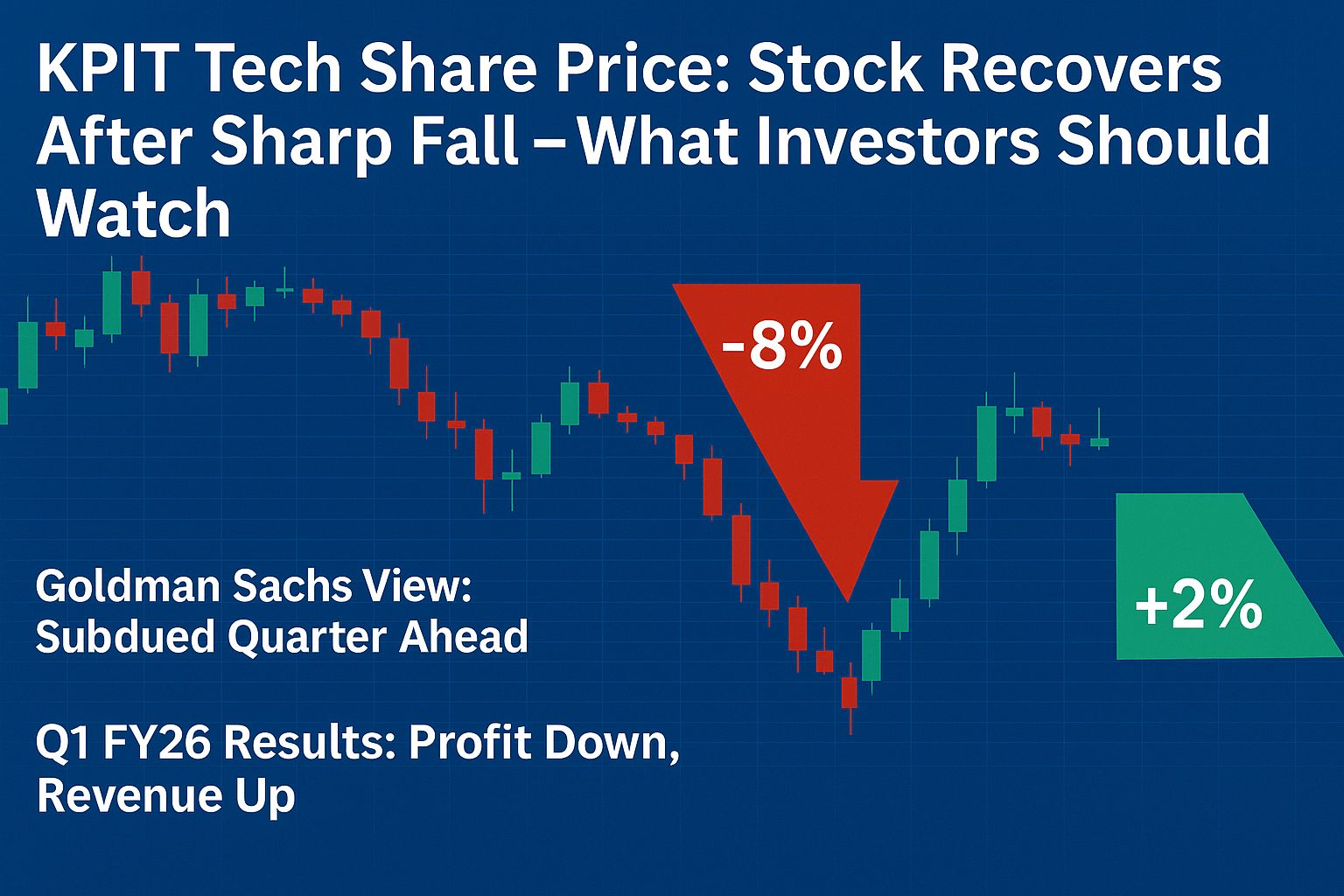

Pune, October 1 (Market Update) – After witnessing a brutal 8% sell-off on Tuesday, KPIT Technologies’ stock showed signs of recovery on Wednesday. Shares climbed nearly 2% in early trade, touching ₹1,118.50 apiece on the NSE.

Goldman Sachs View: Subdued Quarter Ahead

Global investment firm Goldman Sachs has maintained its neutral stance on KPIT Tech. In its latest note, it highlighted expectations of a soft September quarter:

- Organic constant currency (CC) revenue likely to fall by 2%.

- Revenue in US dollar terms projected to decline by 1% sequentially.

- Caresoft acquisition, closed last month, expected to add around $4 million to topline.

JPMorgan Forecast: Washout Year Before Rebound

According to CNBC-TV18 reports, JPMorgan foresees FY26 as a “washout year” for KPIT Tech, with topline estimated to decline by 1% on an organic basis. However, the brokerage expects a strong recovery:

- Growth forecast at 12% in FY27.

- Further expansion to 16% in FY28.

Q1 FY26 Results: Profit Down, Revenue Up

For the June quarter (Q1 FY26), KPIT posted:

- Net profit: ₹171.8 crore (down ~16% YoY, ~30% QoQ).

- Revenue from operations: ₹1,538.7 crore (up 13% YoY).

The decline in profitability was attributed to currency fluctuations and absence of one-time exceptional income, which had boosted last year’s figures.

Co-founder and CEO Kishor Patil commented:

“The mobility industry is going through geopolitical and tariff-led uncertainties. We believe these will settle down in a quarter. Despite macro challenges, we have maintained EBITDA margins.”

Company Background

- Founded in 1990 by Ravi Pandit and Kishor Patil as KPIT Infosystems.

- Headquartered in Pune; IPO launched in 1999.

- Operates in 13 countries with centres in India (Pune, Bengaluru, Kochi), EU, US, Brazil, Thailand, China, and Japan.

Focus Areas

KPIT specialises in embedded software and product engineering for mobility, particularly:

- Autonomous driving / ADAS

- e-cockpit and connectivity

- Cloud and virtualisation

- Predictive diagnostics & maintenance

- Functional consolidation in body electronics

These areas position the company to benefit from the long-term shift toward electric and self-driving vehicles.